Want less choppy income returns?

Get on board.

Our AJ Bell Income and AJ Bell Income & Growth Funds now offer ‘smoothed’ monthly returns and a lower OCF of just 0.50%. Speak to our team to find out more.

Our Income Funds are now better than ever

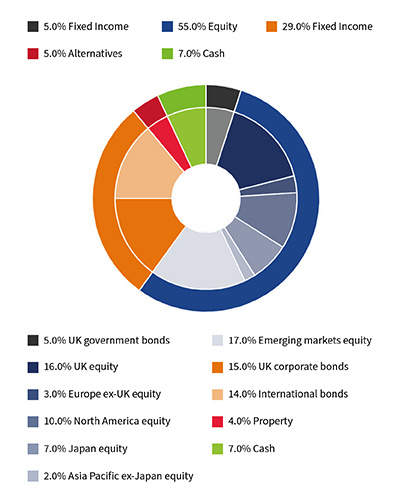

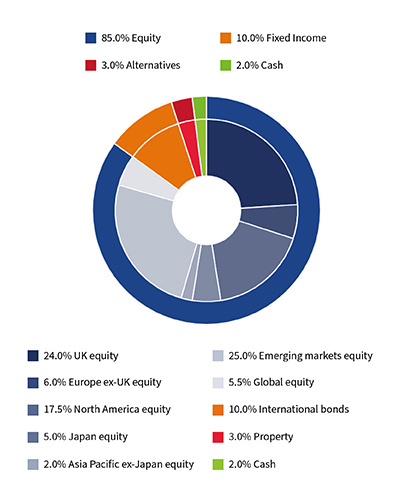

The AJ Bell Income and AJ Bell Income & Growth Funds aim to provide income returns of between 3% and 5%. The former should hold its capital value over time, while the latter seeks to grow capital in line with inflation.

So what’s new?

To reduce fluctuations in the monthly income returns offered by both funds, we’ve introduced a way to provide more equal income payments throughout a fund’s accounting year, with one larger payment at their year end (31 March).

And what about the price?

The best part? This extra predictability comes at no extra cost. In fact, we’ve actually made both funds cheaper, reducing the OCF from 0.65% down to just 0.50%.

Performance on the up

We think the performance of both Funds speaks for itself.

Read the Q1 2025 reports – spoiler: it’s good news.

Source: Morningstar. Values calculated on a total returns basis, as of 31 December 2024. This performance data is derived from the NAVs of each product, which are calculated net of fees.

Income yields: what do they really really tell us?

Investors seeking natural income often compare equities and bonds, but headline yields can be misleading.

While dividend yield provides a simple snapshot for equities, bond yields are more complex, incorporating factors like price fluctuations and the ‘pull to par’ effect.

Compiled by our expert Investment Team, this whitepaper explores:

-

the key differences between dividend yield, current yield, and yield to maturity (YTM);

-

how bond price movements and the ‘pull to par’ effect influence income returns over time; and

-

how AJ Bell approaches managing income-focused funds and portfolios.

As we grow, so does our buying power. Our commitment on costs means we promise to pass back any savings we make to investors in the form of a lower OCF.

Get in touch for more information on how our Funds could help your clients achieve their income needs.

Key portfolio documents

For more information on our AJ Bell Funds range, view our extensive range of literature.

Meet the team behind the Funds

AJ Bell Investments is a crew with more than 100 years’ collective experience of managing funds for retail and institutional investors, and of building sophisticated investment management solutions.

Ryan Hughes

Managing Director

Richard Slattery-Vickers

Head of Product

Paul Angell

Head of Investment Research

James Flintoft

Head of Investment Solutions

Ian Aylward

Head of Investment Partnerships

Frequently asked questions

What are income funds?

Income funds focus on providing investors with a regular income stream, typically based on the coupons paid by bonds, dividends from equities, or the interest paid by cash funds.

How do income funds work?

Income funds distribute the income they generate as cash, which is paid into the investor’s account at regular intervals. In the case of our AJ Bell Income Funds, these payments are made monthly.

What is meant by ‘smoothing’?

Smoothing aims to reduce fluctuations in the monthly income return from our Funds by giving investors 11 more equal income payments a year, with one larger payment after the end of the accounting period in March.

Who are the AJ Bell Income Funds designed for?

These Funds have been designed for investors who are looking to improve their returns on cash or generate an income in retirement. The funds offer a competitive yield – albeit with the day-to-day fluctuations in value that come with investments in risky assets such as shares and bonds.

If you’d like to discuss these Funds in more detail, let us know and we’ll arrange for the appropriate representative to get in touch. It’s plain sailing, really.

The value of investments and the income from them can go down as well as up and your client may not get back their original investment.

Past performance is not a guide to future performance and some investments need to be held for the long term.

The information on this page is intended for professional advisers only.

Authorised and regulated by the Financial Conduct Authority.